China is increasingly leveraging its dominance over rare earth minerals as a strategic tool in its economic standoff with the U.S., creating major disruptions for American defense manufacturers. A growing number of U.S. military suppliers are facing delays and skyrocketing costs—some paying up to 60x the usual price for critical materials like samarium, vital for jet engines and missiles.

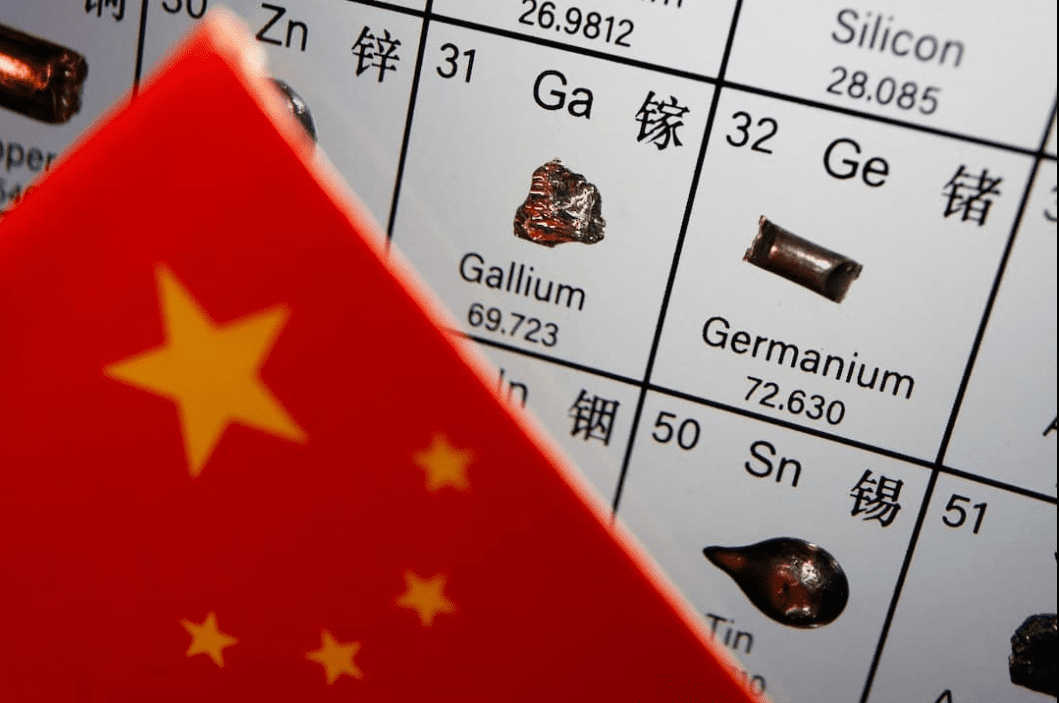

In April 2025, Beijing imposed strict export controls on seven rare earth elements, requiring licenses that are difficult to obtain. This move was widely seen as retaliation for U.S. tariffs. As a result:

- Over 78% of U.S. weapons systems are now at risk due to supply disruptions.

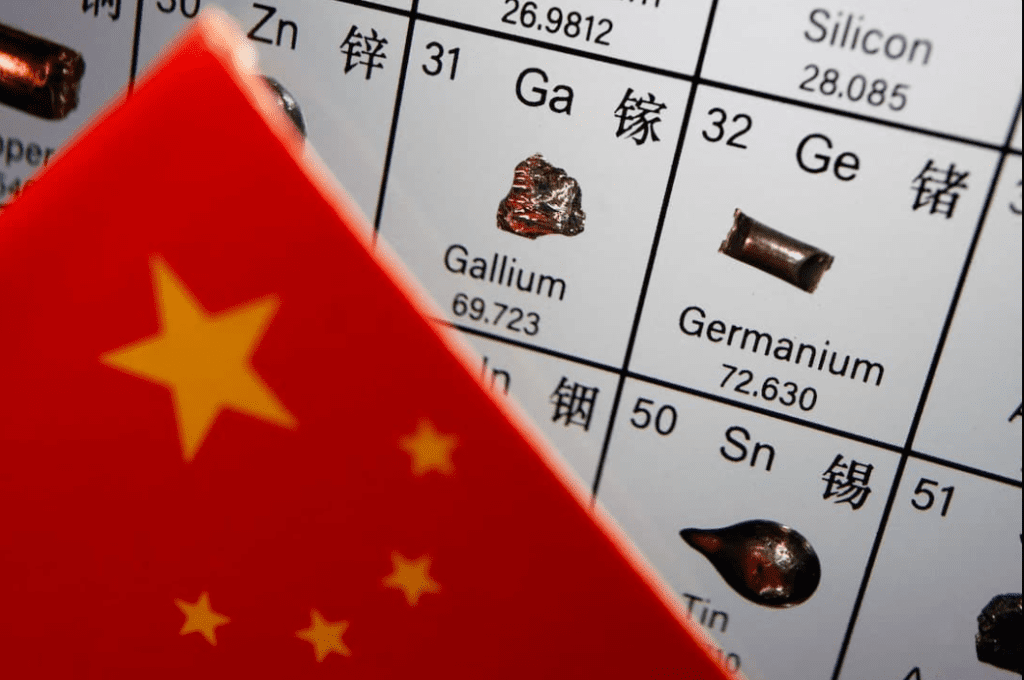

- Leonardo DRS and others report dangerously low inventories of materials like germanium.

- China’s monopoly is severe—it refines 90% of rare earths globally and 98.8% of gallium.

The Pentagon has ordered all defense suppliers to eliminate Chinese rare earth magnets by 2027, but with most companies holding only minimal stockpiles, this mandate poses a huge challenge—especially for smaller firms.

Despite $439 million invested by the U.S. government since 2020 to build a domestic supply chain, experts warn full independence may take 15–20 years. For now, critical materials still flow through Chinese refineries—even those mined in the U.S.